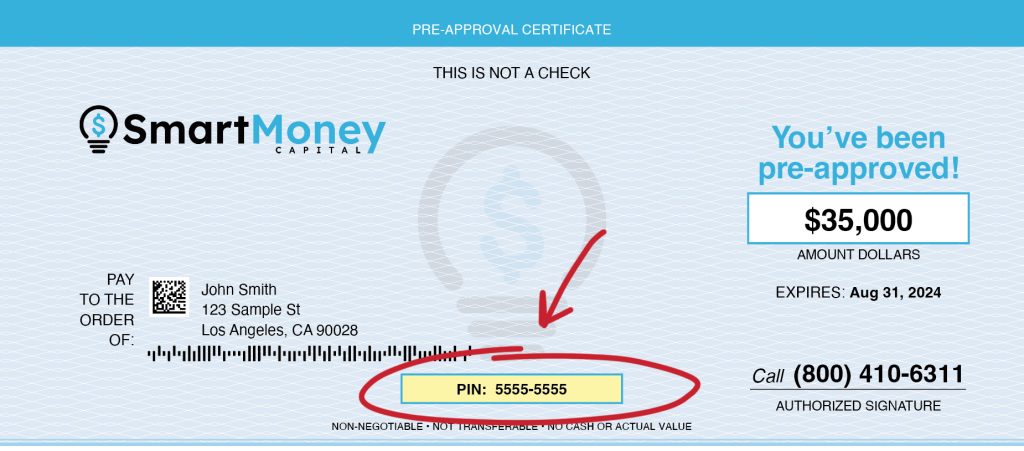

Loans

We help you find flexible loan options, whether you're consolidating debt or working toward your financial goals—all with competitive rates and terms that fit your needs.

Our simple 3-step process

1. Apply Online

2. Verify Info

3. Collect Funds

Personal Loans

$1,000 - $100,000

From time to time, we all need a little help. Whether you’re looking to pay off outstanding balances or want to finish a home improvement project, we’re here for you. We understand the importance of time, so we’ve made our pre-qualification and approval process as simple as possible. Let’s get you the support you need today.

Will not impact your credit score.

FAQs

No, providing your basic information will not impact your credit score. To determine how much you qualify for, we conduct a “soft pull” on your credit, which does not affect your score. If you decide to proceed with the loan application, a “hard inquiry” will be run to verify the accuracy of your application. This inquiry will be reported to at least one of the credit reporting agencies and may impact your credit score.

Unsecured loans are loans that aren’t backed by collateral. Instead of relying on a borrower’s assets as security, approval on unsecured loans is based on a borrower’s creditworthiness and signature. All personal loans offered are unsecured loans.

There are no application fees and no pre-payment fees. The only fee is a standard loan origination fee.

No, we’ve done our best to streamline and simplify the process as much as possible. If you’d prefer, we’ll walk you through the process and happily answer any questions you have over the phone. Feel free to call us directly at (800) 410-6311.

Most borrowers receive their funds within 24 to 48 hours of approval. Please note that funding times may vary depending on bank processing times and holidays.